Trust Deeds

The Trust Deed is the most important component of the Trust. In Malaysia, Trust Deeds are a part of the Trusts that are governed by the relevant laws on Trusts.

The Trust Deed, the Trustee, the Settlor and the Beneficiaries are the key components that make up the Trust.

The Trust Deed is an agreement between the Settlor and the Trustee. The Trust Deed is a legal document on how to manage properties and assets of an estate. It will have the list of assets, trustees and beneficiaries of the Trust. The Trust Deed is a confidential document visible only to the Trustees. The Trust Deed is the foundation of the Trust.

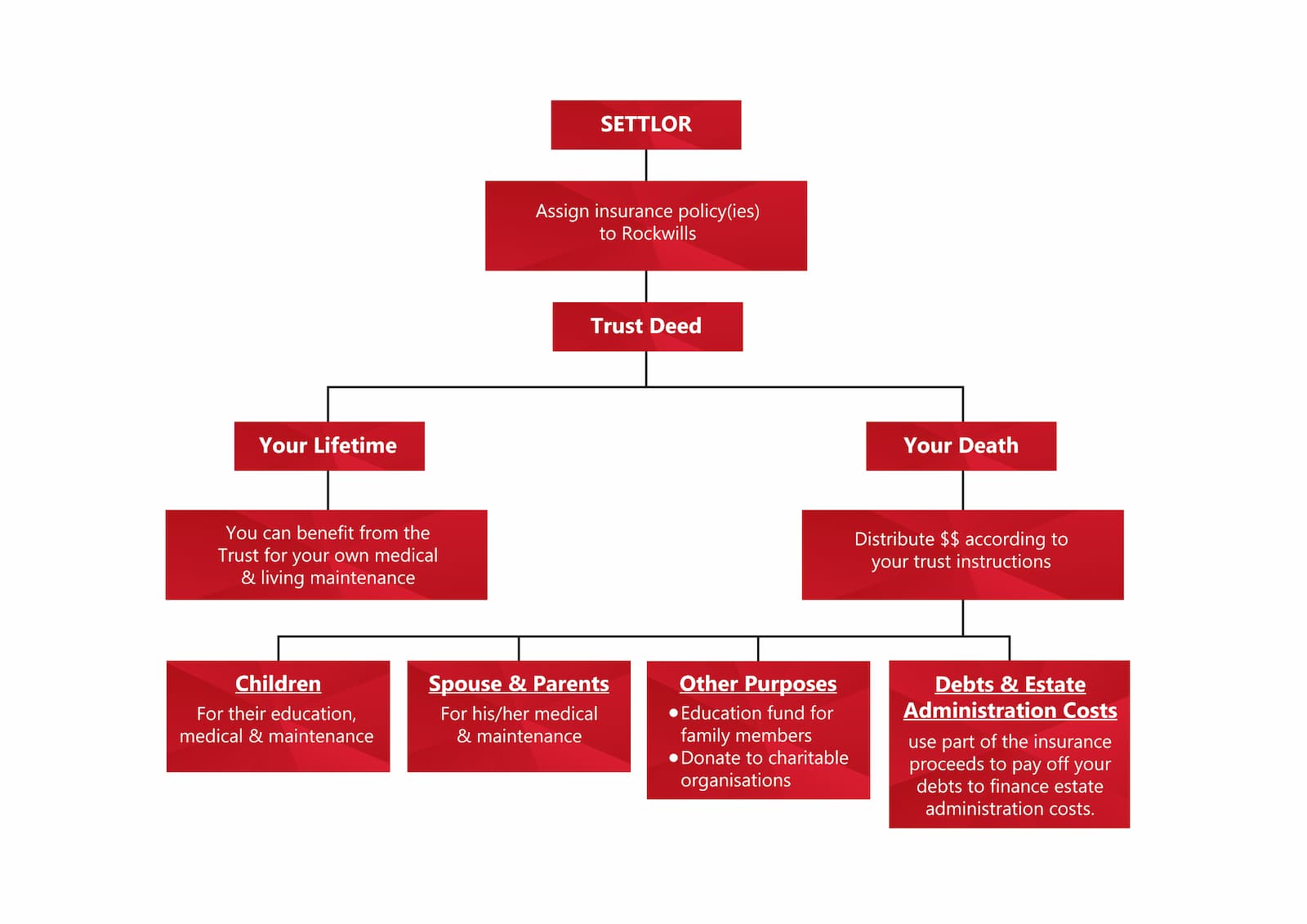

The Trust Deed contains the instructions on how to manage the assets and how to distribute the income or the assets itself to the respective named beneficiaries. The diagram below shows how a simple Insurance Trust works. You can see the Trust Deed is the controller of how the assets in the Trust is to be distributed or used.

The person (Settlor) transfers legal ownership of selected assets to the Trust while still alive. The Settlor can also be a Trustee of the Trust. And observe the Trust Deed at work and make changes to the Trust Deed if required. The Trust is not part of the person’s Estate.

A Will only takes effect on the death of the person (Testator), leaving the distribution process to the Will and the government. Any part of the Estate, if not mentioned or covered in the Will, is made intestate by the Government and will be distributed based on the Distribution Act.

Anything can be written into a Trust Deed. A professional trustee like Rockwills with its team of professionals will guide you on what can be written into the Trust Deed.

There are many types of Trusts. This can be for tax management, inheritance and transfers, pet custody, guardianship of children, retirement income, insurance proceeds management, steady income for loved ones, control heirlooms from disposal and sale, shareholdings and many more items can be written into the Trust Deed.

• You need the help of a Professional Estate Planner.

• The estate planner needs to have a team of people who can support the different types of Estate complexity for your Trust Deed requirements.

• This estate support team should include specialist lawyers, accountants, tax and finance and company secretaries.

• Rockwills franchisees are professional estate planners, with in-depth training in estate planning, Rockwills estate planning processes and support services.

Rockwills Trustee Services

Rockwills Private Trust Services

Rockwills provides a range of services for wealth distribution management. This product offers a Private Trust setup service in Malaysia.

Rockwills Buy Sell Trust

Rockwills Buy-Sell Trust

This Rockwills Buy-Sell Trust ensures the smooth transfer of shareholding between shareholders on disability or death of a shareholder. It is a powerful business succession planning tool to ensure the continued success of the business.

Contact Rockwills Franchisee and Estate Planner Levine Lee

Rockwills Franchisee and Estate Planner, Levine Lee is available to advice, guide and plan your estate administration and types of trusts needs. Whether its will writing services or trustee services.

You can call or WhatsApp to Rockwills franchisee Levine Lee at +6012-684-0948 or send in the form below. She will get touch with you based on your request in the form.

Types of Trusts in Malaysia Enquiry Form

Request for Estate Planning Advice / Quotation

At Red Cover Life Planning, we emphasize our people- helping them grow, expanding their abilities, and discovering new opportunities. Join us now to be part of our team and story.