Flexible employee benefits insurance plans

AIA Group Insurance is called A-SME Flex. This group insurance from AIA offers flexible healthcare coverage options and benefits to fit the company’s needs and budget.

Click the button below to contact AIA Insurance Agent Levine Lee, to answer your questions on this insurance plan.

Or send in enquiry. We will contact you to create the best insurance quotations to fit your employee benefits plan needs.

A-SME Flex AIA Group Insurance

A-SME Flex AIA group insurance is a one-stop source for all employee benefit needs, providing comprehensive protection and solutions to small and medium-sized enterprises.

Your employees are the driving force behind your company. You need a flexible group insurance plan to ensure that their health and welfare are well taken care of.

A-SME Flex AIA Group Insurance Coverage

AIA group insurance offers companies a variety of healthcare coverage options and benefits to suit different budgets, as well as the demands of various types of businesses. You can customize the plan according to your employee’s protection needs with our wide range of benefits, including outpatient benefits, life, critical illness, and many more.

Employees are your greatest asset. Looking after your employees are looking after your business.

AIA Group Insurance Solution for SMEs

| Benefits Recommendation | ||||

| – Create the right plan for your employees | ||||

| Flexible & Customisable | ||||

| – Flexibility to pick and choose benefit options and limits | ||||

| Comprehensive Plan | ||||

| – More options to suit different needs and budgets | ||||

| Digitalised | ||||

| – Fast and seamless experience |

AIA A-SME flex at a glance

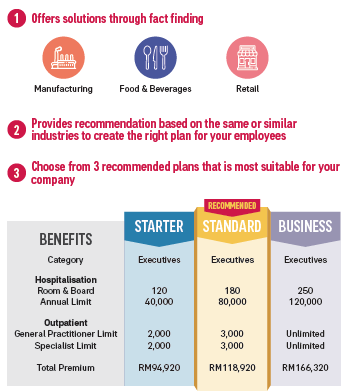

Benefits Recommendation

• AIA provides recommendations and need-based solutions through fact-finding.

• Enables you to benchmark with companies of the same or similar industries to create the right plan for your employees.

• Provides the right benefits package to help you attract and retain employees.

Flexible & Customisable

• Customise your group health plan, select the medical and term life coverage that suits your business needs and budget.

• Flexibility to choose from an extensive range of benefits and sum insured options for different category of employees.

Deductible

• Deductible options to help you manage costs while providing health coverage relevant to your employees’ needs.

• With deductible, you will also be able to manage any risk of unnecessary claims or misuse as your employees would also participate to manage the cost.

Group Medcare

• Exclusive access to Personal Medical Case Management services, ensuring your employees receive the best possible treatment and personalised on-going support throughout their medical journey when diagnosed with a serious or complex condition.

• Supported by a dedicated and personal medical team, led by a personal medical case manager to reassess and manage your employee’s medical condition.

Corporate AIA Vitality

• Designed to build a healthier workforce for your employees and you.

• Corporate AIA Vitality is an add-on health programme for group insurance, that empowers employees with knowledge and tools to make healthier choices, and also motivates and rewards you and your employees to get healthier. Healthy employees means higher productivity.

How A-SME Flex Makes Group Health Insurance Convenient

From considering and purchasing the right plan to managing your policy and claims, your journey with A-SME Flex is made easier and more convenient. Here’s how:

- Easy to choose. Here at AIA, we provide benefits recommendation based on your industry to help you create the right plan for your employees.

- Easy to customise. We offer a range of plans and optional benefits to suit different budgets and needs.

- Easy to buy. Our application process is simple, fast,, and hassle-free. Get your quote on the spot, confirm, sign, and submit electronically.

- Easy to manage. Managing employee benefits is time-consuming. We provide hassle-free experience from onboarding to the claim process; offering advantages such as an e-Medical card, claim reimbursement in 5 days, and a variety of value-added services at your employee’s finger tips.

AIA Group Insurance Medical Benefits

Hospital and Surgical Care

AIA group insurance cares for your staff by providing them with a complete group hospitalization plan. AIA selects from a wide range of benefits options to provide the most suitable insurance plan for your employees by group. You also have the option to provide hospitalization coverage for your employees’ dependents.

| Room & board | Choose from RM80 to RM600 |

| Overall limit | Choose from RM20,000 to RM400,000 |

| Class insured | Per Member / Per Family |

| Plan type | Cashless / Reimbursement / Government Hospital (GH) only |

| Deductible | RM0 / RM300 |

Optional Group Insurance Medical Benefits

Outpatient Care

AIA provides your employees and their dependents the convenience of accessing outpatient care at General Practitioner (GP) and Specialist Care (SP). Together with a hospitalization plan, your employees will enjoy comprehensive healthcare coverage.

General practitioner (GP)

| Overall limit | Choose from RM1,500 to RM5,000 or unlimited |

| Plan type | Panel Clinics / Panel & Non Panel Clinics |

| Deductible | RM0 / RM5 / RM10 |

Specialist Care (SP)

| Overall limit | Choose from RM1,000 to RM5,000 or unlimited | ||

| Plan type | Cashless / Reimbursement / Referral / Direct Access / Direct PAED | ||

| Deductible | RM0 / RM15 / RM30 |

Outpatient Care Limit

Standalone limit / Combined GP & SP limit

1 Per Family Limit is not available for Outpatient Medical Benefits.

2 Cashless, Direct Access, and Direct PAED is subject to minimum limit of RM2,000.

AIA Group Insurance Term Life Basic Benefits

Life Benefit

The Term Life Benefit provides your employees with financial security in the event of an untimely death. Any company with an employee group size between 11-200 will be given a No-Evidence Limit (NEL) of RM200,000. With the NEL, we will insure your employees without requiring any evidence of insurability (i.e. Personal Health Declaration Form)

Total and Permanent Disability

If an employee becomes disabled as a result of an injury or sickness, the compensation from this benefit can help reduce the financial burden suffered.

Partial and Permanent Disability

Compensation according to the Scale of Indemnity as stated under the Policy’s Schedule of Benefits will be paid if an employee suffers a permanent partial disability as a result of sickness or accident.

This benefit will be paid if the Insured Member passes away within twelve (12) months of suffering from a Terminal Illness.

Repatriation Expenses

Covers expenses for transportation of mortal remains back to the Country of Origin if the Insured Member passes away while traveling outside of Malaysia.

AIA Employee Benefits Life Insurance

Optional Group Insurance Term Life Benefit

A serious illness can be a financial burden. When diagnosed with a critical illness, the insured member will receive compensation which would help ease some of the financial burden

Optional AIA Group Insurance Benefits

Group Medicare

Personal Medical Case Management (PMCM)* is a value-added benefit that provides:

• Access to the world’s leading specialist

• Medical support from diagnosis to recovery

• 24/7 Personalised support

* This benefit is applicable to Group Medical Plan only.

Corporate AIA Vitality

AIA Vitality is a science-backed health programme that rewards your employees’ healthy choices. It empowers them with the knowledge, tools and motivation to achieve their health goals. Using the latest research in behavioural economics and incentives, it is designed to encourage long-term behaviour changes in health. Organisation can leverage on AIA Vitality platform to drive employee health and engagement.

Terms & conditions apply

Company in Malaysia Group Insurance

Allianz Group Insurance

Allianz Group Insurance is called Allianz SME Choice Plus. If you want to get a quote for Allianz group insurance for your employees, please contact us below for Allianz group quotations.

Great Eastern Medical Insurance

Great Eastern Group Insurance is called Great BizCare (GBC). If you want to get a quote for Great Eastern group insurance for your employees, please contact is below for Great Eastern group quotations.

Expert AIA Insurance Agent KL Malaysia

Get Immediate Advice

Insurance Planning Expertise – Ready to Help

Levine Lee has over 12 years of working experience with AIA and ING Insurance as an insurance agent and life planner. Contact LEVINE LEE at +6012 684 0948. She can work with you to create the best plan to meet your employee benefits program and budget plans.

Group Medical Insurance Enquiry

At Red Cover Life Planning, we emphasize our people- helping them grow, expanding their abilities, and discovering new opportunities. Join us now to be part of our team and story.