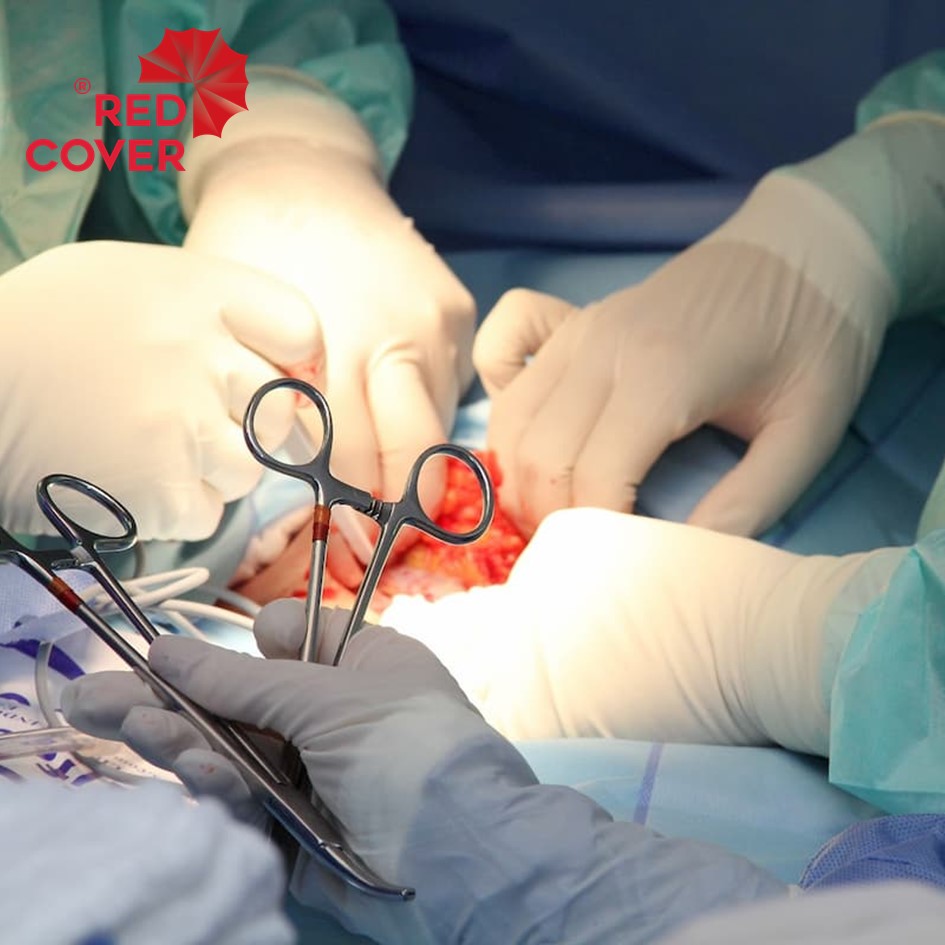

Insurance Letter of Guarantee serviced by Red Cover Life Planning for AIA Insurance Malaysia, gives you immediate access to leading private hospitals nationwide.

AIA Medical Insurance Card Malaysia

This is a medical insurance plan from AIA Insurance.

- A-Life Med Regular provides you the medical coverage up to the age 100.

- A-Life Med Regular pays your medical claim in full, without imposing any co-insurance or deductible charges.

- You can be the policy owner for your spouse and children to register for medical insurance

- You can get income tax relief with this medical card up to RM3,000

- Enjoy worldwide assistance services by calling AIA’s 24-hour service hotline +603-21665421 and reverse the call charges.

- The plan details and downloads are in the detailed description below

Send in this pre-order to get the official proposal for you. Nothing needs to be paid for this pre-order.

Guarantee Letter

The letter of guarantee is offered by the insurer to the hospital confirming that the insurance company will cover the cost of treatment for the patient.

While medical cards allow you to walk to the hospital without worrying about the amount of cash in your wallet, it does not always happen. Along with medical cards, what is required is also a letter of guarantee – especially for more serious medical cases.

How does Insurance Letter of Guarantee benefit you?

What is the purpose of a letter of guarantee, anyway?

The cashless* admission process at panel hospitals**

For prompt processing of your admission, please present your medical card together with your Identity Card (or Birth Certificate in the event the Insured is a child) and referral letter, where applicable, to the Hospital Admission Officer. You are required to sign Claim Form upon admission to the hospital and an Approved Claims Statement at the time of discharge.

Admission to non-panel hospitals

In the event, you seek treatment from a non-panel hospital, you will first have to pay the charges in full. Once this done, you may sub it your claims together with all the necessary documentation, namely the original hospital bill and medical report, to our insurance company for reimbursement ***.

Please note that reimbursement claims are subject to terms and conditions based on your Policy.

Daycare surgery

You can use your cacheless facility with our insurance for covered surgical conditions which does not require an overnight stay at a panel hospital.

24 hours availability

You can use your medical card 24 hours a day, 7 days a week.

Travel Abroad

If you encounter a medical emergency when travelling outside Malaysia for less than ninety (90) consecutive days, call the International Medical Assitance (IMA) 24-hours service hotline at +603 2166 5421 for assistance and waiver of deposit for admission. All bills must be settled before you discharged from the hospital.

Once this done, you may submit your claim together with all the necessary documentation, namely the original hospital bill and medical report, to our insurance company for reimbursement***.

* Our insurance company’s cashless facility is subject to eligibility and will be available if you are treated by our insurance’s panel specialists at any of our insurance’s listed panel hospitals. Any non-eligibility or invalidity will be communicated to you through the hospital. Please note that there will be no Insurance Letter of Guarantee issued for the first three (3) months of your policy. In the event you are hospitalized during this period, you will have to settle your hospital bill and medical report, our insurance company for reimbursement.

** Please note that there are some specialists within the appointed panel hospitals that have no working arrangement with our insurance. Policyholders who seek treatment from non-panel doctors will have to pay the charges in full and thereafter submit your claim with all the necessary documentation, namely the original hospital bill and medical report, to our insurance company. For reimbursement***. Claims for all eligible expenses incurred will be paid according to customary and reasonable charges.

*** Please note that reimbursement claims are subject to terms and conditions based on your policy.

Get Insurance Advice

Contact Levine Lee, our Life Planning Advisor to get in touch with us and start your insurance advice coverage plan now. Get covered correctly. Be advised correctly. Call us today to be advised on the best insurance protection personalized for you.

Medical, Life and Group Insurance - Request for Quotation

"*" indicates required fields