Wealth Distribution

Wealth distribution is an important element of planning your life. Whether you have a small amount or a very large amount, you will need to plan on what happens to your wealth holdings (also called your Estate). when you pass away. Anything can happen at anytime, and you have loved ones, pets, or favorite charities around you.

If you do not have a plan for wealth distribution, then the government steps in to distribute according to the laws of distribution in Malaysia.

Click the button below to contact Rockwills franchisee Levine Lee, to answer your questions on this service.

Or send in enquiry. We will contact you to advise and create the proposal that best fits your need.

Wealth distribution is the distribution of a person’s properties and holdings to selected people or entities. These are called beneficiaries. Wealth and Beneficiary Management is very important to ensure your hard earned wealth is managed the way you want it after you have passed on.

The total wealth and possessions of a person is called the Estate. A piece of jewelry or an art collection is considered part of your estate. Each item needs to listed in the Will.

How to list these items of the Estate and assign beneficiaries, is where professional will writers with a national standardized template come in to guide you in the process. They can guide you on what item of wealth is to be listed in the Will, in line with the laws of Malaysia.

If this is not done, then items not listed in the Will, but belonging to the Estate of the deceased, will be considered as the residual estate. If the residual estate is not treated correctly in the Will, it will be treated as intestate. Then the government steps in and distributes the wealth according to the Distribution Act of Malaysia.

The government steps in and does the job. The government will assign an Estate Administrator to settle the debts and then distribute the wealth according to the various laws on wealth distribution of Malaysia.

The institutions in this case can be the High Court, Amanah Raya Bhd or the Small Estate Distribution Unit. They each have their own people, processes, documents and turn around times to get this done. Until then, your estate and monies cannot be used by your loved ones.

Wills and Trusts are two very effective tools to plan the distribution of wealth. When you make a Will, you are called a Testator. This is your Will and Testament for your Estate. The Will is executed when you pass away. The beneficiaries listed in the Will are notified and the Will is then made public.

When you make a Trust, you are called a Settlor. This is a Settlement of how your property or specific items will be managed by the Trust. These properties then belong to the Trust. You can become a Trustee of the Trust. And still control the properties via the Trust Deed. The Trust starts working while you are still alive and you can still control it accordingly.

The beneficiaries listed in the Trust start getting the benefits per the instructions in the Trust Deed. The Trust Deed is confidential and only the Trustees and Settlor know the details.

The Trust is not your Estate. It is a legal entity on its own right, managing your handed over properties per your instructions.

The Will however, gives instructions on how to distribute your Estate. If parts of your Estate is not mentioned in your Will (the residual estate), then the government will decide for you.

You need to be very specific who the beneficiaries of the Will or Trust will be. And you need to be very specific on what the beneficiaries should be getting.

You should also name the beneficiaries of your residual estate in your Will with a clause on residual estate beneficiaries. The residual estate are the items of your estate that you would own, after the Will is created. These items need to be distributed too and you may not need to rewrite the Will to list these items.

The wealth distribution instructions are listed in the Will and Trusts. Insurance policies can be assigned to Insurance Trusts or be part of the Private Trusts.

A properly guided and written Will and Trust Deed is very important. You need someone with the understanding of the Malaysian Law, Accounting practices and Insurance policies to answer and guide you in writing your will and setting up your private trust.

Rockwills has nationwide standard templates for Will Writing and Trusts Creation. Rockwills has standardized and well trained franchisees in estate planning to guide you on the right tool and the instructions to control your wealth distribution to your wishes.

The Distribution Act of Malaysia essentially controls wealth distribution in Malaysia. However, the State Laws of Sabah and Sarawak have laws unique to those states, that complement the Distribution Act of Malaysia.

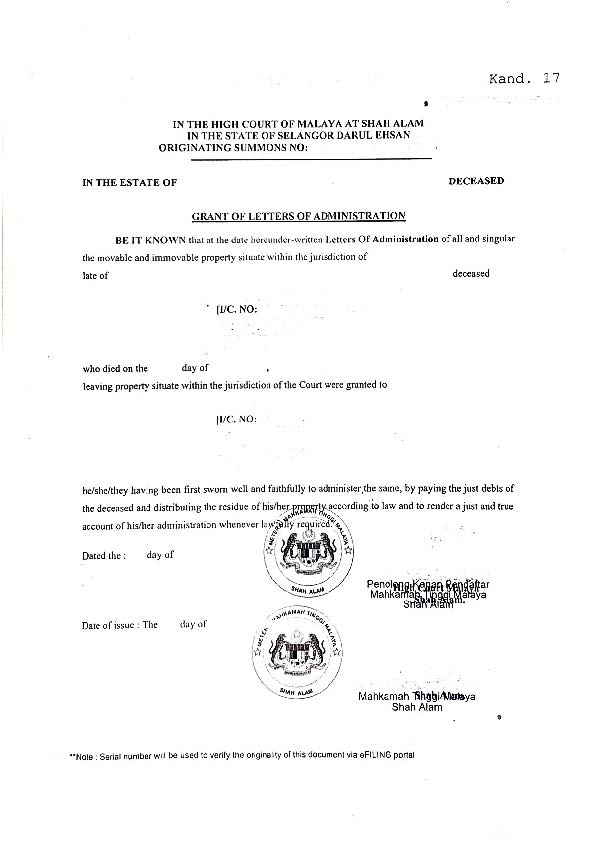

The government controls the distribution of wealth and properties in Malaysia through the Distribution Act. This is done through the Malaysian court grant documentation. The Grant of Probate or the Grant of Letter of Administration. This process is called Estate Administration.

Yes. Rockwills keeps Wills highly confidential with their Wills Custody services. The tight security on the Wills Vault ensures only the authorized people can see the Will.

The Trust Deed is a highly confidential document. It is available only to authorized people as stated in the Trust Deed and controlled by the Trustee.

• You need the help of a Professional Estate Planner.

• The estate planner needs to have a team of people who can support the different types of Estate complexity for your Trust Deed requirements and Will Writing requirements.

• This estate support team should include specialist lawyers, accountants, tax and finance and company secretaries.

• Rockwills franchisees are professional estate planners, with in-depth training in estate planning, Rockwills estate planning processes and support services.

Rockwills Will Writing and Will Custody Services

Rockwills Will Writing and Will Custody Services

Rockwills provides a range of services for wealth distribution management. This product offers both Will writing in Malaysia and Will safe keeping (custody) services.

Rockwills Buy Sell Trust

Rockwills Buy-Sell Trust

This Rockwills Buy-Sell Trust ensures the smooth transfer of shareholding between shareholders on disability or death of a shareholder. It is a powerful business succession planning tool to ensure the continued success of the business.

Rockwills Trustee Services

Rockwills Private Trust Services

Rockwills provides a range of services for wealth distribution management. This product offers a Private Trust setup service in Malaysia.

Contact Rockwills Malaysia Franchisee and Estate Planner Levine Lee

Rockwills franchisee Levine Lee is available to advice, guide and plan your estate administration needs. Whether its will writing services or trustee services.

You can call or WhatsApp to Rockwills franchisee Levine Lee at +6012-684-0948 or send in the form below. She will get touch with you based on your request in the form.

Request for Estate Planning Advice / Quotation

At Red Cover Life Planning, we emphasize our people- helping them grow, expanding their abilities, and discovering new opportunities. Join us now to be part of our team and story.