Liability Insurance in Malaysia

Liability insurance in Malaysia is used to pay for third party claims and legal costs for specific types of damages found to be caused by the insured party. The insurance company indemnifies and pays on behalf of the insured party.

This payment is made based on the Malaysian laws on liability and damages. The payment for claims is made once the claim is accepted by insurance company investigations or awarded by the Malaysian courts.

Red Cover Insurance Agents Calculate Premiums and Coverage

These policies coverage and premium calculations will differ between insurance companies. Their terms and conditions will be different too.

Red Cover insurance agents get you proposals, from insurance companies in Malaysia, for coverage on your specific business liabilities and risks. Contact us with your coverage needs and questions.

Types of Claims for Liabilities Coverage in Malaysia

Types of Liabilities and Damages Covered

The types of liabilities to third parties covered by law in Malaysia are:

- Injuries to people

- Death of people

- Damages to property

- Total loss of property

The payment is made, when these damages are found to be the result of lack of care on the part of business operations, project works, product statements or professional work.

Liability for Claims Based on Specific Type of Activities

Liability insurance is available for specific types of damages within Malaysia or specific territories. This enables:

- The legality of claims to be targeted to specific activities or misadventures

- The sum insured to be based on the legal precedence of compensation for that claim

- The cost of liability insurance is then controlled to the expected practices of the activity

The liability insurance taken in Malaysia will be easier and cost effective to implement. As these are in compliance with Malaysian laws and precedents. Which reduces legal time and costs in court with the insurers familiarity of Malaysian court rulings and awards.

Insurance Companies and Agents for Liability Insurance

Our experienced business insurance agents can guide you on which insurance type to use based on your requirements. They work with several insurance companies such as AIA Insurance, RHB Insurance, Allianz Insurance, Great Eastern Insurance, Generali Insurance, Liberty Insurance, Tokio Marine, MSIG, or Takaful Ikhlas, and many more to get you the best plans and prices for your requirements.

This will differ between insurance companies and their policies’ fine print. Get a reliable general insurance agent to guide you in comparing and evaluating the insurance proposals from different insurers.

Types of Liability Insurance Policies in Malaysia

List of Liability Insurance Policies

These are the common types of insurance policies that include liability coverage, issued by the main insurance companies in Malaysia.

- Public Liability Insurance Policy

- Workers Compensation Insurance Policy

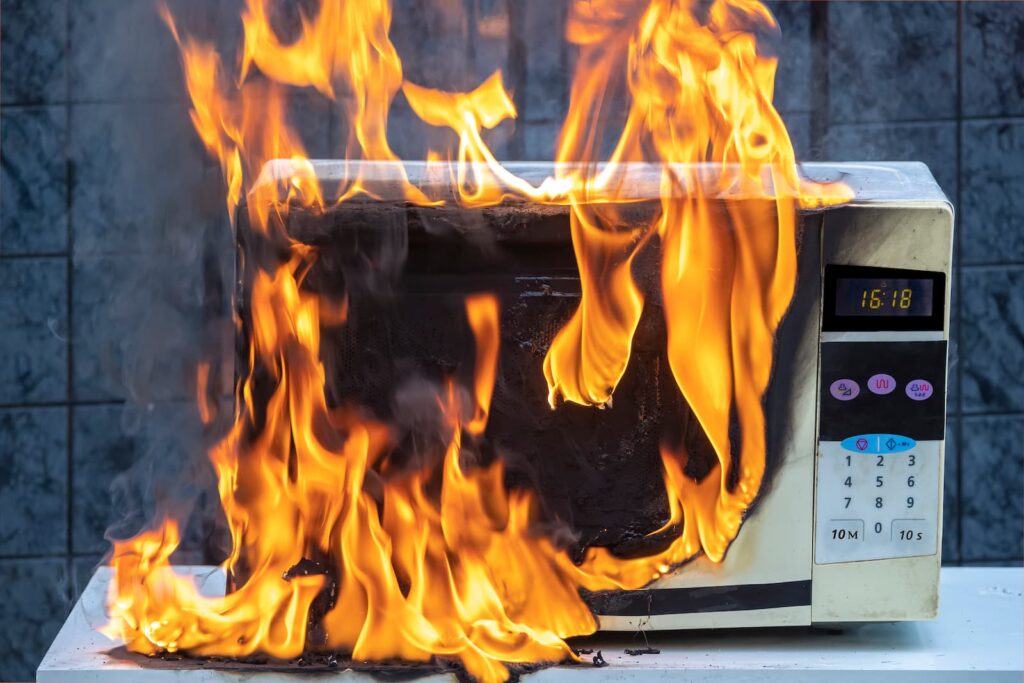

- Product Liability Insurance Policy

- Food and Drinks Poisoning Insurance Policy

- Contractors All Risks Insurance Policy

- Erection All Risks Insurance Policy

- Marine Liability Insurance Policy

- Port Risks Insurance Policy

- Professional Indemnity Insurance Policy

- Passenger Liability Insurance Policy

- Art Workshop Insurance Policy

Liability Insurance Policy Customized Coverage

These insurance policies will have:

- Sum insured and indemnified

- Liability covered and Indemnified

- Claims legal processes

Each liability insurance policy is customized to the insured party’s needs. The operations, works doing, track records, types of risks and perils faced or possible and many more.

Liability Insurance Policy Premiums and Price Cost Calculation

Each of these policies will have customized proposal forms to be submitted. And the complexity of the forms, will be different between each insurance company.

Most people will get guidance from experienced insured agents in structuring their insurance policies cost effectively.

If you are an SME (Small Medium Enterprise) in Malaysia, with a wide range of activities, request for the SME Customized Liability Insurance from us. Red Cover will work with the insurance companies to get you a customized insurance to cover your business needs.

Click the button below, if you want a quotation for any of the above requirements.

If your requirement is unlisted, then contact LEVINE LEE, at +6012 684 0948. She is the focal point for initial customer contact.

Public Liability Insurance

Public liability insurance protects a business against claims for injury and damage from the public or other third parties. This excludes claims from employees.

This is a general duty of care by a business or person. The business takes care that its business operations are according to best practices or regulations. Ensuring no injury or property damage to the members of the public from its operations.

Get Public Liability Insurance details at:

Workers Compensation Insurance

It is a an employer’s liability insurance to cover for workers compensation. To protect an employer’s liability for an injured worker or worker suffering from occupational diseases from the workplace.

It is also known as workmen compensation insurance or worker compensation law coverage insurance.

Get Workers Compensation Insurance details at:

Product Liability Insurance

A product liability insurance in Malaysia, is to protect the insured against claims for damages caused by the product. The product would have been made, distributed or sold by you.

Get Product Liability Insurance details at:

Food and Drinks Poisoning Insurance

For restaurants, food and drinks poisoning is a legal liability to the provider in Malaysia. The food or drinks provider can be sued for a poisoning incidence. Food and drinks insurance is provided to cover for such incidents.

Get Food and Drinks Poisoning Insurance details at:

Contractors All Risks Insurance

A Contractors All Risks Insurance covers material damage and third party liabilities for a civil engineering project.

This insurance plan is treated as a comprehensive insurance to cover risks and damages to materials and harm to third parties on the work site, occurring during the period covered by the policy.

Get Contractors All Risks Insurance details at:

Erection All Risks Insurance

An Erection All Risks Insurance covers material damage and third party liabilities for an installation, erection and commissioning of a structure or plant engineering project.

This insurance plan is treated as a comprehensive insurance to cover risks and damages to materials and harm to third parties on the premises’ work site, occurring during the period covered by the policy.

Get Erection All Risks Insurance details at:

Marine Liability Insurance

Marine Liability Insurance covers damages to the environment, collisions, port or harbour, other vessels, watersports equipment, sports fishing gear and passengers on board are covered too.

Get Marine Liability Insurance details at:

Port Risks Insurance

Port Risks Insurance policy is a marine insurance coverage that covers the safety risks and liabilities of the ship while it is stationed in a port.

Get Port Risks Insurance details at:

Professional Indemnity Insurance

A professional indemnity insurance is to protect the insured against claims for damages resulting from negligence or lack of care in their work. This work would be provided in terms of services and solutions as provided by the professional, their partners or their employees.

Get Professional Indemnity Insurance details at:

Passenger Liability Insurance

People travelling in private transport like a private car or van, need to be covered by a passenger liability insurance policy. This is cover for any liabilities to third parties in the car.

Get Passenger Liability Insurance details at:

Art Workshop Insurance

Insurance for art workshops primarily is to provide protection to the organizer, participants, and property from potential risk and liability. Insurance agents might propose different types of insurance policies based on the business activity.

Get Art Workshop Insurance details here:

Contact Insurance Agent for Best Insurance Proposals in Malaysia

Levine Lee has over 18 years of working experience with AIA and ING Insurance as an AIA life insurance agent and life planner. Jeffrey Teoh has over 10 years of distinguished working experience with the best group insurance company in Malaysia, including Allianz. And Colin Chow is a trusted Great Eastern insurance agent with over 13 years of experience in the industry.

Contact AIA INSURANCE AGENT LEVINE LEE, at +6012 684 0948. She is the focal point for initial customer contact. Jeffrey Teoh, Colin Chow, or other Red Cover insurance team members will step in to contact you depending on your insurance requirements.

Levine and her team can work with you to create the best insurance proposal and quotations to meet your needs and budget plans within Malaysia. The team can get you quotations from various Insurance Companies in Malaysia for your personal, life, general, group, and business insurance needs.

Send in the form below for your requirements.

Liability Insurance – Request for Quotation

At Red Cover Life Planning, we emphasize our people- helping them grow, expanding their abilities, and discovering new opportunities. Join us now to be part of our team and story.