AIA A Life MediFlex Insurance Policy

A Life Mediflex is a comprehensive and flexible medical card insurance from AIA. This medical insurance provides a complete and total health solution at an affordable price.

This AIA medical insurance is previously known as A-Life Med. Read below to learn more about the benefits and coverage offered under this medical insurance plan.

Contact Insurance Agent for Medical Insurance

Click the button below to contact AIA Insurance Agent Levine Lee, to answer your questions on this insurance plan.

Or send in enquiry. We will contact you to create the best insurance quotations to fit your medical insurance plan needs.

AIA A Life Mediflex Insurance

This AIA medical card insurance is designed around three pillars. Where each crafted to prioritize the policyholder’s health and well-being.

Live Well

Protect Well

Get Well

This pillar encourages proactive health management to keep you at your best.

This pillar is to protects against the unexpected medical cost.

This pillar ensures the timely and top quality healthcare services when needed.

With this comprehensive medical insurance from AIA, the policyholder can enjoy the peace of mind that comes with knowing they are protected from escalating healthcare expenses.

AIA Medical Card Insurance Benefits

The AIA medical card insurance offers various benefits to provide financial security and access to quality healthcare. This includes before the hospitalization, during the hospitalization, and after the hospitalization.

1. Pre Hospitalization

Before the hospitalisation, AIA will cover the costs of the diagnostic tests, specialist consultations, medications, and medical treatments.

2. Hospitalization

AIA covers hospital expenses including hospital room and board, hospital supplies and services, surgical procedures, operating theatre costs, anesthesiologist and physicians’ fees, and other necessary medical costs. Additionally, AIA covers one guardian (for both juniors and seniors) to accompany them during the holiday stay.

3. Out Patient Treatments

Our coverage includes out-patient treatments for kidney dialysis, cancer, bronchitis, dengue fever, influenza, and pneumonia, as well as day care procedures and surgeries, and emergency accidental. Including dental treatment.

4. Post Hospitalization

After hospitalization, AIA covers the costs of diagnostic tests, specialist consultations, medications, and medical treatments. Inclusive of physiotherapy, chiropractic, and acupuncture treatment.

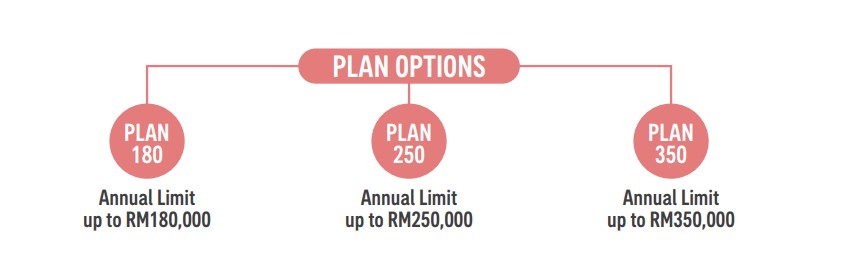

AIA Medical Insurance Plan Options

The AIA medical card insurance plan comes with different options to match various needs and budgets. These options allow the policyholder to choose what works the best for their health needs and financial capabilities.

AIA Medical Insurance – A-Life Mediflex vs A-Life Med Regular

See the table below for the summary highlighting the differences between the current and previous AIA medical card insurance plans:

| Feature | A-Life MediFlex | A-Life Med Regular |

| Plan options | Offers multiple plans with varying annual limits and options for deductibles | Offers multiple plans with varying annual limits and options for deductibles |

| Health Management | Includes health rewards through AIA Vitality for proactive health management | Emphasis on health management and more on straightforward medical coverage |

| Coverage Details | Detailed coverage for in-patient, out-patient, recovery, and additional rider options such as A-Plus MediBoost and A-Plus MediRecover. | Primarily covers hospitalization and surgical benefits, emphasizing full payment of claims without additional charges. |

| Special Feature | Personal Medical Case Management services under certain plans, guiding treatment and recovery | Provides worldwide assistance and income tax relief up to RM3,000, ensuring global coverage and financial benefits |

More on AIA Medical Card Insurance

Click here to read more on the Frequently Asked Question on AIA medical insurance.

Click here to read more on the policy under AIA medical card insurance.

Click here to read more on the AIA medical card claim submission process.

Get Insurance Advice From Our Experienced Medical Insurance Agent

Financial Security – It is There When Needed

Levine can help you to protect yourself and the future of your loved ones. Get immediate financial security. Don’t touch your savings. Let insurance provide it.

She can help provide financial security in times of hardship and will be able to ease the financial burden of your dependents in your absence.

Contact our AIA INSURANCE AGENT LEVINE LEE to get in touch with us and start your personal coverage, group coverage or choose your plan now. Get covered correctly. Be advised correctly. Call Levine Lee (+6012-684 0948) today to be advised on the best insurance protection personalized for you. Or send us the form below on your interest.

Medical, Life and Group Insurance – Request for Quotation

"*" indicates required fields

At Red Cover Life Planning, we emphasize our people- helping them grow, expanding their abilities, and discovering new opportunities. Join us now to be part of our team and story.